Claudio Osorio flew on private jets, hobnobbed with sports stars, politicians and generals and was hailed as entrepreneur of the year. Now he faces multiple lawsuits saying he duped investors out of millions.

BY JAY WEAVER AND GERARDO REYES

BY JAY WEAVER AND GERARDO REYES

jweaver@MiamiHerald.com

Only days after Haiti’s massive earthquake, entrepreneur Claudio Osorio boarded a private jet with an entourage of movers and shakers: former Miami Heat star Alonzo Mourning, ex-U.S. Army Gen. Wesley Clark, one-time FEMA director David Paulison, Miami businessman Chris Korge and Osorio’s philanthropist wife, Amarilis.

The Gulfstream G550 belonged to Ryan Freedman, the young scion of a wealthy New York family, who had loaned $3.75 million to Osorio’s latest venture, InnoVida, a manufacturer of high-tech, prefabricated wall panels for low-cost housing.

The jet was loaded with a team of doctors and tons of medicine for the Haitian people, but the humanitarian trip was also the public relations opportunity of a lifetime for Osorio and his new company.

Now, more than a year later, the promise of that flight seems like a distant memory: Osorio has made no progress on his pledge to build a community of InnoVida “cabins” in Haiti, where tens of thousands still live in tents and other make-shift shelters. Instead, Osorio himself confronts the stark reality of a major court fight with several angry investors and lenders, who say the Venezuelan-born entrepreneur deceived them. Korge, Freedman, pro basketball star Carlos Boozer and others are suing the high-flying Miami Beach businessman and his company for tens of millions of dollars amid allegations of fraud.

InnoVida’s board of directors — which once boasted marquee names such as Clark, former Florida Gov. Jeb Bush and Miami condo king Jorge Perez in company promotional materials — has also been disbanded.

At least five lawsuits, along with related court declarations and testimony, now accuse Osorio — a one-time Fortune 500 CEO known for capitalizing on his connections to people in the worlds of business, charity and politics — of tricking investors and lenders into backing a fledgling international business built on falsehoods, fabrications and fake documents.

Freedman sued, claiming his company received a phony wire transfer indicating that a Hong Kong bank had paid Osorio’s overdue loan payment in October. It never arrived.

Korge, regarded as a shrewd developer who is also a lawyer, says Osorio has a rare talent for charming people and winning their trust. He says Osorio assured him that InnoVida had about $40 million in cash and that a Middle East sovereign wealth fund would be buying $500 million worth of InnoVida stock — a cash infusion that never materialized.

“I took him at his word,” said Korge, who invested $4 million in InnoVida, which included $3 million borrowed from his close friend, Miami-Dade lobbyist and businessman Rodney Barreto.

In an interview this month at his attorney’s Miami office, Osorio said he never duped Korge — or anyone else — into investing in his start-up company. If anything, he said, Korge, a former Miami-Dade lobbyist who had made millions off development deals and concession businesses, was motivated by his own greed.

Osorio said he made “no inducements” to entice Korge into signing an agreement in December 2009 that allowed him the option to buy up to $9 million worth of InnoVida shares. “No shareholder was invited into InnoVida on the prospect of making a quick buck,” said Osorio, 52, who lives on exclusive Star Island in Miami Beach. “We’re still one and a half to two years away from going public.”

That remains to be seen: Early this month, a Miami judge found Osorio in default for failing to turn over financial records in Korge’s case and stripped the InnoVida CEO of the authority to run his company, appointing a receiver to take control and dig deep into its finances, including locating money owed to various investors, lenders and other creditors.

Following the judge’s actions, Osorio told The Miami Herald that InnoVida, with headquarters on Miami Beach’s Lincoln Road, has between $100 million and $200 million in total assets, including $25 million of cash on hand.

Yet that financial picture seemed to be contradicted by an initial report filed by the court-appointed receiver, lawyer Mark Meland. He reported that, according to Osorio, InnoVida has no “sources of funds” to pay for the company’s operating expenses. The receiver also found that:

• InnoVida’s corporate account at Wachovia in Miami has a balance of $87,000. Another corporate account at the Royal Bank of Canada in the Cayman Islands has a current balance of $12,000. Yet, records show InnoVida had deposited tens of millions of dollars in cash in that off-shore account. “The receiver has reason to believe that there are significant foreign-held assets, in particular cash, that will ultimately be traced to InnoVida, its subsidiaries, Claudio Osorio or Amarilis Osorio,” Meland wrote, noting the Grand Cayman account has been dormant for six months and temporarily frozen. “The Osorios have provided no adequate explanation.”

• A 2009 company report filed with the IRS showed that InnoVida’s 12 foreign accounts had a total value of more than $37.5 million, Meland wrote, adding he has received “no adequate explanation” for what happened to that money.

• Bank records also show that InnoVida wired millions of dollars over several years to an entity called Miami Worldwide Partners, which then transferred the money to the personal account of Elba Gamboa. She was the “de facto controller” of InnoVida’s factory operations and assistant to Osorio and his wife. “Ms. Gamboa advised that those funds were used to pay employees of [the couple]; however, no adequate documentation has been provided supporting such claims. Other monies in this account were used to pay the mortgage on Mr. Osorio’s residence in Telluride, Colorado.”

This past week, Circuit Judge Valerie Manno-Schurr granted the receiver’s request to scale down InnoVida’s operations and, if necessary, to file a Chapter 11 bankruptcy petition to protect the financial interests of creditors and investors. She forbade the Osorios from transferring any money in bank accounts in their names – without the receiver’s permission. She also ordered them to surrender their passports temporarily until a March 21 hearing on the matter.

In addition, the judge ordered the couple to turn over the financial records of InnoVida and related companies, and to sit for depositions with the receiver. On Friday, during his deposition, Osorio invoked his Fifth Amendment right against self-incrimination several times when Meland asked him questions related to allegations of fraud — including whether he transferred any of InnoVida’s money to himself, his wife or their children for personal expenses, according to lawyers present.

Osorio, in the earlier interview, said he understood why the judge was upset with him about not turning over his company’s financial records. But he stressed it has been difficult obtaining those documents from joint-venture partners in foreign countries, such as the United Arab Emirates, Oman, Tanzania, China and India. “The fact is, we don’t have control of them,” he said.

But Manno-Schurr, who criticized Osorio for showing “no respect” to her court, said she was still in the dark as far as InnoVida’s worth: “I don’t know the value of this company,” she said at a recent hearing. “Show me the money.”

Osorio’s lawyer, Robert Zarco, said Thursday he was “extremely surprised” by the receiver’s initial report and that he intends to investigate it.

“Our client maintains that the report is inaccurate, grossly exaggerated and a misrepresentation of the true financial picture of the company,” Zarco said. “Our client maintains that none of the monies were used by the company for illegal purposes, and that they were used for proper business matters.

“It is unfortunate that this case was never resolved, tried or decided on the merits, but rather on the client’s failure to produce sufficient documentation,” he added.

POTENTIAL PROFITS

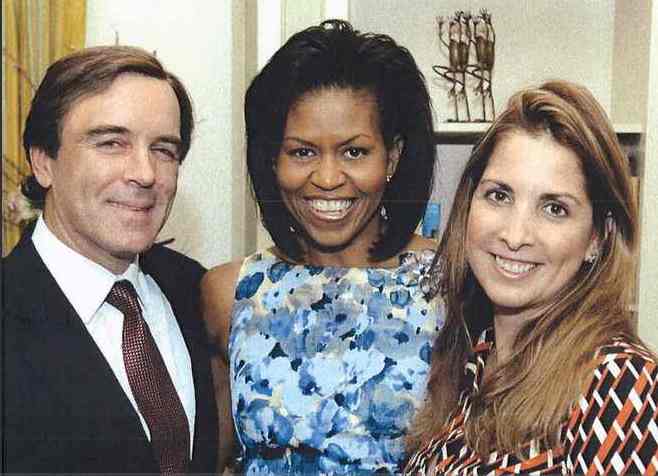

Korge, a major Democratic fundraiser who came to know Osorio and his wife during the Clinton and Obama presidential campaigns, was not the only investor dazzled by the charismatic entrepreneur.

At least a dozen others saw potential profits in Osorio’s company, including one of his Star Island neighbors, a Tanzanian businessman and a group of United Arab Emirate investors.

The Dubai-based investors, including a senior principal, invested a total of $10 million in InnoVida Holdings and an additional $17 million in the company’s joint-venture factories in the United Arab Emirates, Oman and India, according to court records.

In a declaration filed in Miami-Dade Circuit Court, the principal, Jamno Perumal Kalwani, said he became “concerned” about Osorio’s management of the company in early 2009. He said he realized his worst fears when Osorio’s checks for the employee payroll and other expenses at the Dubai factory “bounced.” Kalwani said Osorio “was dodging our calls and concocting ridiculous excuses regarding why he could not pay…the outstanding bills.”

In September, the Dubai factory shut down.

Another group of current and former pro basketball players, including Mourning, Boozer, Dwight Howard and Howard Eisley, also poured about $5 million into Osorio’s company. The players came to know Osorio through a friend. Boozer, a Chicago Bulls star who along with ex-wife Cindy invested $1 million, intends to file his lawsuit this week, said his attorney, David Nunez.

Another major player in the mix: The U.S. government. Just weeks after the Jan. 12, 2010, earthquake in Haiti, the Overseas Private Investment Corporation announced it had loaned InnoVida $10 million to help finance construction of a Haitian factory to build 32,000 “energy-efficient” homes for earthquake victims over the next five years. Osorio said his company would donate 1,000 so-called Haiti Cabins, made from panels of fiber composites, to the earthquake victims.

The factory in Haiti, however, has not broken ground — more than one year after a press conference announcing the project was held at InnoVida’s factory in North Miami Beach, attended by Osorio, Mourning and Clark. Osorio blamed the delay on Haiti’s systemic economic paralysis. He said the company factory has produced building materials and shipped them to Haiti for a new school financed by Royal Caribbean Cruise Lines.

Osorio, meanwhile, faces other pressing problems.

In January, the Swiss government obtained the Justice Department’s assistance to investigate possible criminal charges against him in Switzerland. Authorities there allege Osorio and others fraudulently obtained $220 million in loans from Swiss banks in the late 1990s by lying about the soundness of his previous major business venture, Miami-based CHS Electronics. It was a former Fortune 500 distributor of computers worldwide that filed for bankruptcy in 2000, and settled a securities-fraud case with a class of shareholders the following year.

But lawyers who have sued him over several InnoVida investments say that his past and present problems mirror each other.

“Osorio rose from the ashes of the CHS Electronics bankruptcy only to perpetrate a similar worldwide scheme on other victims,” Miami attorneys Alice Sum and Lilly Ann Sanchez said in a statement. They represent Tanzanian businessman Sanjay Suchak, who has sued Osorio over a $2 million investment in InnoVida.

CUTTING EDGE

Osorio conceived InnoVida in 2005. He envisioned it as a cutting-edge producer of fiber-composite panels for affordable housing and post-disaster shelter in developing countries. His business model entailed forming joint ventures to build factories in Latin America, Europe, Africa and Asia.

Among the first investors to take a bite of InnoVida stock: Osorio’s Star Island neighbor, Turkish tycoon Engin Yesil. In 1990, he was convicted of cocaine trafficking and later assisted authorities in other drug investigations. Yesil went on to make a fortune from a mail-order contact lens business and other enterprises.

In late 2006, Yesil’s accountant introduced him to Osorio. Meanwhile, Yesil’s then-wife, an enchanting Indian model named Ayesha Thapar, came to know Osorio’s wife, Amarilis, through a party on Star Island , according to a lawsuit.

Soon after, Osorio traveled with Yesil to Dubai to tour the InnoVida production plant and model home. In early 2007, Yesil purchased 30 percent of InnoVida for $6.3 million. By that December, Yesil loaned him another $1.7 million, which was converted to more shares in the company.

But Osorio said he didn’t know about Yesil’s criminal record. Osorio said Yesil admitted it a few months after he became an investor. He said Yesil, with head bowed down, confessed before a background check was done. He was going to join InnoVida’s board.

“He told me, ‘I have to tell you I’m going to fail in the vetting process, because I have a prior conviction, a serious conviction on drug trafficking.’

“I told him that he couldn’t be a director,” Osorio said.

Yesil’s attorney, Abbey Kaplan, said Osorio’s version of events was inaccurate, asserting his client informed the entrepreneur of his criminal past before he first invested in InnoVida. “What he’s saying is totally illogical,” Kaplan said, noting that Osorio accepted more of Yesil’s investment money well after the issue of the board position came up in 2007.

Now, Osorio and Yesil are fighting in court. Yesil wants all of his money back, claiming the company he invested in no longer exists because of Osorio’s restructuring of InnoVida. That, he says, effectively shut him out of the business entirely, denying him access to the company’s financial documents, court records show.

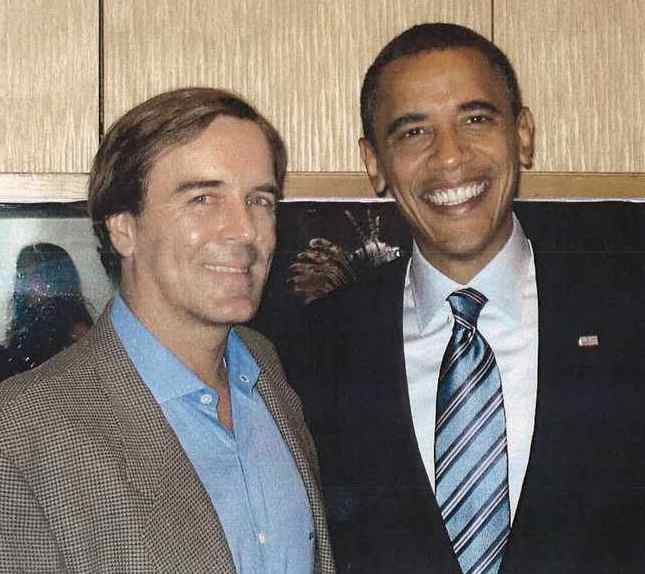

“Osorio used his apparent wealth, connections and success story to lure him in,” said Kaplan. “He’s done a great job of P.R. A who’s who was listed as members of his board of directors: Wesley Clark, Jeb Bush, Jorge Perez. He held fund-raisers for the Clinton and Obama campaigns. These are the people that Osorio indicates he hobnobs with.”

WOOING KORGE

Korge met Claudio and Amarilis Osorio during the presidential primary season. “She told me how she raised millions of dollars for the Gloria Estefan Foundation and the homeless,” he recalled.

In fall 2007, the Osorios hosted a Clinton fundraiser at their home on Star Island.

While their friendship blossomed, Osorio spoke little with Korge about his new venture, InnoVida. But that changed in 2009, when he first asked Korge to sit on the company’s board. Jeb Bush was already a director.

Then Osorio made a “soft sell.” Korge expressed interest as an investor, saying he was impressed with Osorio, his company’s board of directors, financial statements showing about $40 million in cash, and InnoVida’s business model. Korge also visited the company’s “demonstration” factory in North Miami Beach.

So, Korge bought $312,500 worth of shares himself, at 25 cents each.

“Osorio’s many representations about the financial well-being of his company and its cash position – coupled with the illustrious board of directors — created a mirage of success and stability that induced Chris to invest with someone he believed was his close personal friend,” said lawyer Benjamin Brodsky, who represents Korge along with Kendall Coffey.

After the initial stock agreement, Osorio stepped up his sales pitch to convince Korge to exercise his option to buy up to $9 million worth of shares.

One major inducement: Osorio said he was in “final negotiations” with a Bahrain sovereign wealth fund to buy 20 percent of InnoVida for $500 million, at $2.50 a share, according to Korge’s lawsuit. He said that Osorio assured him it was a “done deal.”

So, Korge invested another $700,000 last February and an additional $3 million in March. That money was borrowed from his lobbyist-friend Barreto.

A few months passed. Both Korge and Barreto were growing nervous about the fate of the Middle East deal.

Korge demanded that Osorio return his money. In a late June email: Osorio promised Korge: “As discussed yesterday, I wanted to confirm to you my commitment that $3.7 Million USD will be refunded to you by July 31st.”

Korge says he’s still waiting for the refund: “This guy is never giving anyone’s money back.”